Cash discount and dual pricing regulations updated in 2023. As the payment processing industry continues to evolve, the need to find ways to cut costs and improve profits increases. Thin margins like a small percentual fee per transaction can add up for business owners. These are especially hard on small or new businesses. Businesses are now seeking to streamline payment processes and reduce costs, making dual pricing a popular solution.

For merchants, dual pricing applies as a cash discount — a price reduction offered to customers paying with cash. Dual pricing and cash discounts are also sometimes referred to as zero-cost processing. The discount amount is then subtracted from the total, reducing the amount that the customer owes.

Cash discounts are popular because they offer a lower-cost option for the customer. This also offers businesses a way to cut down credit card processing costs. On the downside of cash discounts, there is the potential for merchants to abuse the system. They may also need to spend the money to invest in a new POS system as some POS systems don’t have that option to do so. It can also cause confusion and dissatisfaction in customers who don’t want to pay more for using a credit card.

There are also federal and state laws in place regarding dual pricing. Therefore, compliance is necessary for any business using these payment strategies. Failure to comply can result in legal issues and financial penalties. There are a handful of benefits for businesses that follow transparent business practices in regulation with federal and state laws. Businesses can enjoy this pricing model by working with payment processing companies, such as PAYARC, to ensure they’re offering compliant payment strategies.

Explanation of Cash Discount and Dual Pricing

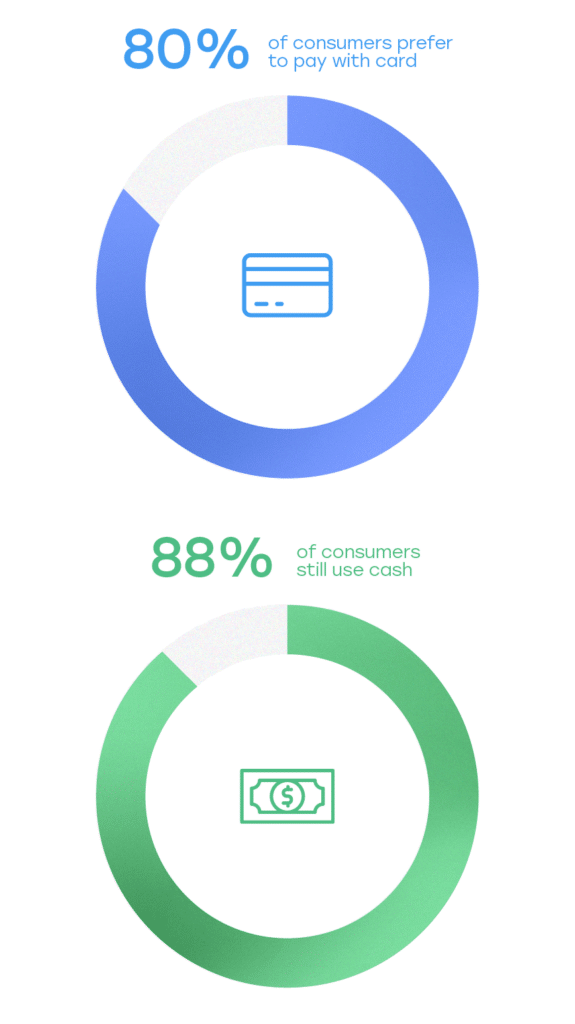

Customers can receive a cash discount when they pay with cash instead of using a credit or debit card. The main purpose of a cash discount is to cover the payment processing fees by passing them onto the customer. This discount typically applies as a percentage of the total purchase price and covers the transaction fees for the merchant. Although 80% of consumers prefer to pay with card over cash, 88% still use cash, making it increasingly important to offer this option. The payments industry no longer uses the term “cash discount,” and now favors the more descriptive term of “dual pricing.”

For example, a restaurant might offer a 4% cash discount to customers who pay with cash. Meaning, if one of their tables run up a $100 bill and pay with cash, they’ll receive $4 off their total check. Dual pricing has been happening at gas stations for some time now. It is also in different iterations such as online vs brick and mortar.

Since up to 183 million Americans have credit cards, it’s important for businesses to cut down on their transaction fees to save money as much as possible. Implementing a cash discount program is wise for businesses as credit card companies continue to increase their rates. In 2022, Visa and Mastercard raised their credit card fees even more for merchants. The cash discount pricing strategy is not only ideal for businesses, but for customers too. As inflation hits a record high, 70% of households are cutting back on unnecessary purchases to cover the high costs of basics.

The Difference Between Cash Discount and Surcharges

It’s easy to confuse cash discount and dual pricing with surcharges, but they are different pricing models. A surcharge, compared to a cash discount, is an additional fee that businesses charge customers who use credit cards to pay for their purchases. This fee is meant to offset the transaction fees that the business pays in processing the card payment.

For example, if a business has to pay a 3% transaction fee, they might add 3% surcharge to the total purchase price for customers who use credit cards.

It’s important to note that cash discounts are legal in all 50 states, while surcharges are only legal in some. Currently, credit card surcharges are illegal in Connecticut and Massachusetts.

Understanding and Complying with Cash Discount Regulations

Businesses that offer cash discounts or surcharges must understand and comply with the policies related to these pricing strategies. Otherwise, they can be penalized. For example, businesses that offer surcharges must abide by the Dodd-Frank Wall Street Reform and Consumer Protection Act. This act requires that any surcharges be disclosed to customers in advance. The surcharge amount must also be reasonable and not exceed the cost of the transaction fee.

Rules and Regulations

Federal Regulations

Dodd-Frank Act

The Dodd-Frank Wall Street Reform and Consumer Protection Act requires businesses that offer surcharges to comply with certain disclosure requirements. Businesses must disclose any surcharge to customers in advance. They also must limit the surcharge to the amount that the business pays in transaction fees. Businesses that offer cash discounts must ensure that the discount is clear to customers and does not discriminate against customers who choose to pay with credit.

Electronic Funds Transfer Act

The Electronic Funds Transfer Act (EFTA) – a federal law that establishes the rights and liabilities of consumers and financial institutions when there are electronic fund transfers. The EFTA allows businesses to offer discounts to customers who pay with cash, or other non-electronic methods of payment. However, the EFTA also prohibits businesses from charging customers extra fees for using electronic payment methods.

Truth in Lending Act

The Truth in Lending Act (TILA) is a federal law that requires lenders to disclose the terms and conditions of credit to borrowers. When businesses offer discounts for cash payments, they must ensure that the terms and conditions of the discount are clear to customers in compliance with TILA.

State Regulations

Specific State Laws

Some states have specific laws related to cash discounts. For example, in California, a business must provide customers with written notice of any cash discount program. The notice must include the amount of the discount and the price charged to customers who don’t pay with cash. Additionally, California law prohibits businesses from charging a higher price for goods or services to customers who pay

with a credit card compared to those who pay with cash.

In Texas, businesses are need to provide customers with written notice of any cash discount program. It must also prominently display signs indicating that a cash discount is being offered. The notice must specify the amount of the discount and the price charged to customers who aren’t paying with cash. Other states, such as Florida,

Indiana, and Oklahoma, have similar requirements for cash discount programs.

It’s important for businesses to be aware of state-specific regulations regarding cash discounts. This is especially important if they operate in multiple states or have an online presence that serves customers across state lines.

Licensing Requirements

Other states require businesses that offer cash discounts to obtain a special license or permit. For example, in California, businesses must register with the state’s Department of Business Oversight if they want to offer a cash discount program. The registration process involves completing an application, paying a fee, and providing certain information about the business and its cash discount program.

Similarly, in Texas, businesses that want to offer a cash discount program must obtain a permit from the state’s Office of Consumer Credit Commissioner. The permit application requires the business to provide information about its cash discount program, including the amount of the discount and the price charged to customers who don’t pay with cash.

Other states may have similar licensing or registration requirements for cash discount programs. Therefore, it’s important for businesses to research the requirements in their specific state(s). They must also ensure that they’re properly licensed or registered before offering a cash discount program.

Compliance Requirements

Compliance requirements remain simple to follow and it’s important that businesses do so as card companies (especially Visa) often deploy secret shoppers to make sure merchants are complying with regulations. Merchants found not complying will get penalties and fines. Two important compliance regulations they might be looking are disclosures and transparency:

Disclosures

Businesses that offer cash discounts must disclose the terms and conditions of the discount to customers in a clear and conspicuous manner. This includes disclosing the percentage of the discount, any limitations on the discount, and any fees or charges that may apply. Additionally, businesses that offer surcharges must disclose the surcharge amount to customers in advance as well.

Transparency

Transparency is a key requirement for businesses when offering cash discounts. Customers must be able to easily understand how the cash discount works and how it’ll affect their total transaction cost. Businesses must also ensure that their pricing practices are transparent and don’t mislead or deceive customers. For example, a business can do this by having a sign in plain sight by the cash register with all the necessary information about their dual pricing.

Ensuring disclosures and transparency in cash discount programs isn’t only a regulatory requirement but also a way for businesses to build trust with their customers. By providing clear and honest information, businesses can create a positive reputation and increase customer loyalty.

Non-discrimination

Non-discrimination is an important aspect of compliance when offering cash discounts. Businesses must ensure that they don’t discriminate against customers who choose to pay with credit. This means that the cash discount must be offered to all customers who pay with cash, or other non-electronic methods of payment.

For example, if a business offers a 3% cash discount, the discount must be available to all customers who pay with cash. The discount cannot be used as a way to charge credit card customers an additional fee or to discourage customers from using credit cards. Non-discrimination is required by federal regulations, such as EFTA, which prohibits businesses from charging extra fees for using electronic payment methods.

Be sure to check out our next blog about the benefits and best practices of compliance.